COMPANY OVERVIEW

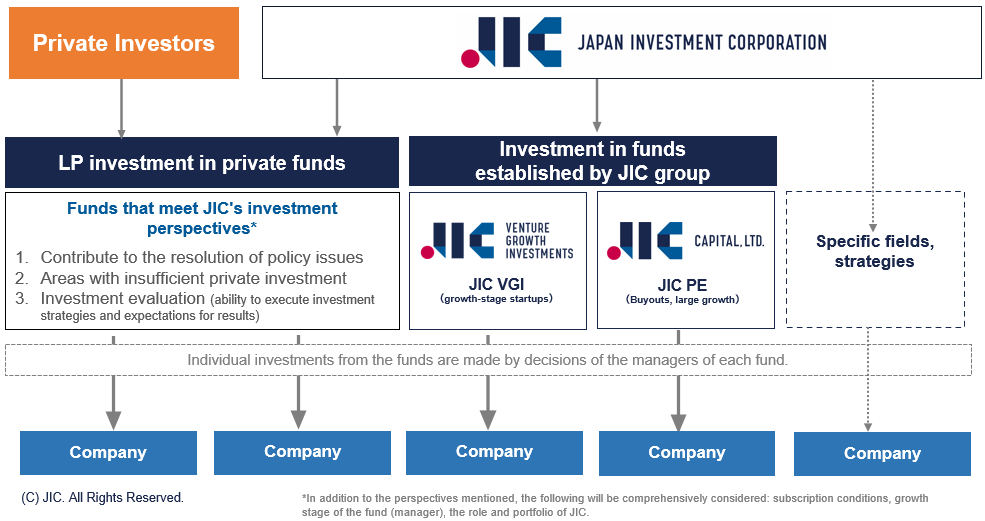

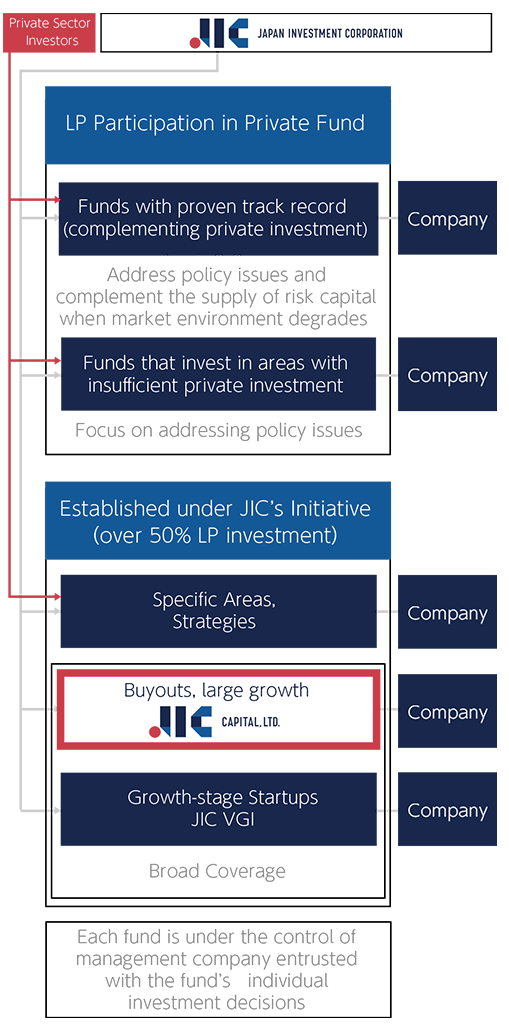

JIC Capital aims to supply risk capital to achieve policy objectives of creating a positive cycle of domestic investment and innovation, promoting business portfolio transformation for enhancing the international competitiveness, and establishing next-generation social infrastructure to promote Digital Transformation (“DX”).

| Company Name | JIC Capital, Ltd. |

|---|---|

| Representative | President and CEO Shogo Ikeuchi |

| Location |

Tokyo Toranomon Global Square 8F, 1-3-1, Toranomon, Minato-ku, Tokyo |

| Business activities | Equity investment and consulting related to equity investment activities |

| Established | September, 2020 |

| Funds under Management |

JIC PEF1 Limited Partnership ・Total commitment amount:¥200.0 Billion JIC PEFJ1 Limited Partnership ・Total commitment amount:¥900.0 Billion JIC PEF2 Limited Partnership ・Total commitment amount:¥600.0 Billion JIC PEFJ2 Limited Partnership ・Total commitment amount:¥200.0 Billion |

KEY FEATURES OF JIC CAPITAL

- Enhance

International

Competitiveness of

Japanese Industries - Aim to enhance the Japanese industry’s international competitiveness through provision of sufficient risk capital in order to achieve industry-wide-goals such as solving structural issues in each industry and realizing Society 5.0, one of the Japanese government’s growth strategies.

- Provide

Sufficient,

Long-term

Risk Capital - Provide neutral and trustworthy risk capital for investments with significant impact on the enhancement of Japanese industry’s competitiveness. Such investments would otherwise not be covered by the private sector due to size and/or investment time horizon.

- Investment

Track Record

of INCJ* - Fully utilize knowledge and experience honed in INCJ’s unique, high social impact investments, such as industry reorganization, overseas investments and other large-scale and complex transactions. A core team of investment professionals from INCJ succeed this knowledge base in conjunction with their past experience from investment funds and professional firms in the private sector

*INCJ/Innovation Network Corporation Japan: Established in 2009, INCJ aimed at overcoming boundaries between companies and industries, creating and nurturing key industries via open innovation for the prosperity of future generations. With the enforcement of the Act of Partial Revision of the Industrial Competitiveness Enhancement Act, the company began a new stage of activities as Japan Investment Corporation (JIC).

- Hands-on

Support

for Value

Enhancement - • Provide hands-on support to enhance corporate value of portfolio companies by deploying resources and measures tailored to the needs of each portfolio company.

• Utilize experiences accumulated through INCJ’s value enhancement activities and support value enhancement in response to portfolio companies and ownership ratio.

- Commitment to

Investment

Disciplines - • Maintain strict discipline in investment activities in order to enhance mid-to-long term value enhancement of portfolio companies with due consideration for all stakeholders as an escort runner.

• Operate investment activities, taking account into ESG as an important investment policy among global asset management community.

- Uniqueness

of the

Public/Private

Fund - • Originate investment opportunities and create value for portfolio companies, utilizing wide network of corporations and industries (built on its trustworthiness and neutrality), together with its strong relationship with government bodies and other public entities.

• Expand overseas network with advanced investors and corporations with cutting-edge technologies, and introduce such network to portfolio companies and domestic industries

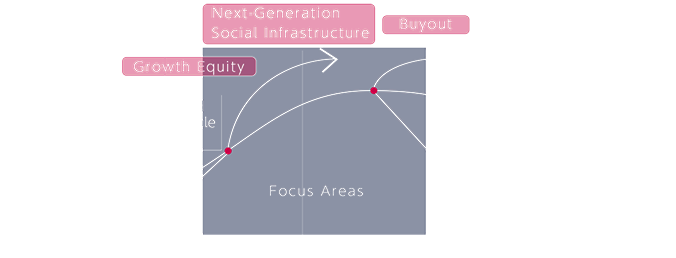

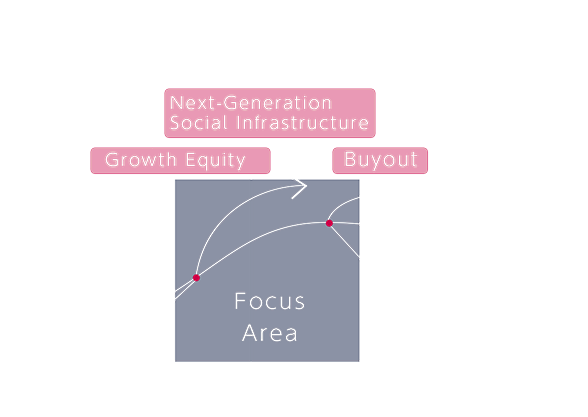

JIC CAPITAL’S TARGET

STAGE

AND SEGMENT FOCUS

Focused business development stages

Investment in

Emerging Sectors

Investments in companies with advanced technologies and services, which lead to the creation of new business and industries.

Investment in

Maturing

Sectors

Investments in companies to enhance the international competitiveness of Japanese industries through transforming business portfolio in large scale.

news room

-

2025/10/31

JIC and JICC to establish new private equity fund (JIC PE2)

-

2025/06/11

“Notice Concerning Transition to a Company with an Audit and Supervisory Board and Appointment of Directors and Audit and Supervisory Board Members” for SHINKO ELECTRIC INDUSTRIES CO., LTD.

-

2025/03/28

Announcement of Joint Investment (MBO) with KKR in Topcon Corporation (Securities Code: 7732)

-

2025/03/19

Announcement Regarding Result of the Tender Offer for the Shares of SHINKO ELECTRIC INDUSTRIES CO., LTD. (Securities Code: 6967) by JICC-04, Ltd.

-

2025/02/17

Announcement Regarding Commencement of the Tender Offer for the Shares of SHINKO ELECTRIC INDUSTRIES CO., LTD. (Securities Code: 6967)

-

2025/01/21

Announcement Regarding Progress of the Tender Offer for the Shares of SHINKO ELECTRIC INDUSTRIES CO., LTD. (Securities Code: 6967) by JICC-04, Ltd.

-

2024/10/31

Notice Regarding Cancellation of the Management Integration through Merger between Toyo Aluminium K.K. and UACJ Foil Corporation, and Termination of the Basic Agreement on the Management Integration by Consent

-

2024/08/26

Announcement Regarding Progress, etc. of the Tender Offer for the Shares of SHINKO ELECTRIC INDUSTRIES CO., LTD. (Securities Code: 6967) by JICC-04, Ltd.

-

2024/06/27

Appointment of Directors and Auditors for JSR Corporation

-

2024/04/17

Announcement Regarding Result of Tender Offer for JSR Corporation (Securities Code: 4185)

team

-

Shogo Ikeuchi

President and CEO

President and CEO of JIC Capital. Prior to joining JIC Capital, he worked at Recruit Holdings for 32 years holding key management positions as an executive officer, executive director, and advisor, focused on overseas business development, digital transformation, corporate planning and HR. He holds M.S. from Kyoto University Graduate School of Engineering.

Outside Director of JSR Corporation (present) -

Osamu Itabashi

Managing Director

Osamu Itabashi has 17 years' experience in private equity investments. He focuses on mobility, semiconductors / electronics, IT, telecom infrastructure, and transportation industries. Prior to joining JIC Capital, he worked at INCJ with 8 deals of buyouts, business consolidations, curve-outs, and growth capitals. Prior to INCJ, he worked at a global private equity fund supporting investments / value-up for 3 years and worked at Boston Consulting Group for 6 years after Tokio Marine & Nichido Fire Insurance. He holds Bachelor of Laws from Hitotsubashi University.

Board Director (Non-Executive) of Astemo, Ltd. (present)

Outside Director of JSR Corporation (present)

Director of Board of SHINKO ELECTRIC INDUSTRIES CO., LTD. (present) -

Yasutaka Nukina

Managing Director

Yasutaka Nukina has 18 years of experience in private equity investments. He focuses on the materials, manufacturing/engineering and decarbonization/circular economy, industries. Prior to joining JIC Capital, he worked at INCJ, handling five deals involving buyouts, business consolidations, carve-outs, and growth capital. Before INCJ, he practiced law at Mitsui, Yasuda, Wani & Maeda from 1994 to 2000, and at Shearman & Sterling from 2000 to 2002, advising on finance, M&A, and dispute resolution matters. He also worked at Morgan Stanley, supporting M&A and finance as an investment banker, and at Advantage Partners as a fund manager of the PIPES/Engagement fund. He is a certified management consultant and admitted to the Bar of Japan and the State of New York.

He holds a LL.B. and an LL.M. from Sophia University, as well as an LL.M. and a J.D. (Halan Fiske Stone Scholar) from Columbia Law School.

Outside Director of Topcon Corporation (present) -

Fumikazu Ito

Managing Director

Fumikazu Ito has over 20 years of experience in alternative investments. Before joining JIC Capital, he spent 10 years at Daiwa Securities Group's investment division, where he was responsible for risk management after his tenure at Nippon Credit Bank. During his career, he has been involved in various private equity investments, overseeing activities from investment decisions to monitoring and exit management. He played a key role in enhancing the investment risk management framework of the group. Additionally, he worked on the front team of the division for 10 years, supporting private equity investments, debt investments, and M&A advisory services. He holds an MBA from Keio Business School.

-

Keisuke Ohnishi

Managing Director

Prior to joining JIC Capital, Keisuke Ohnishi worked for Toyota Motor Corporation (R&D), Boston Consulting Group (Principal), Development Bank of Japan Group (DBJ-IA), PwC Strategy& (Partner), among others.

He has over 15 years of experience in corporate and business strategy, M&A/PMI, organizational and governance reform, and turnaround, primarily in the manufacturing industry (automotive, chemical, electronics).

Keisuke earned both his master’s and bachelor’s degrees in engineering from the University of Tokyo. -

Kohei Nokami

Director

Kohei Nokami has 13 years' experience in private equity investments. He focuses on mobility, manufacturing / engineering, semiconductors / electronics, material / chemical, social infrastructure, and transport equipment industries. Prior to joining JIC Capital, he worked at INCJ with 6 deals of business consolidations, curve-outs, co-intestments of overseas management resources, and growth capitals. Prior to INCJ, he worked at Enterprise Turnaround Initiative Corporation of Japan focused on turnarounds, worked at ORIX supporting turnarounds and financial advisory, and worked at Sumitomo Mitsui Banking supporting corporate finance. He holds B.S. from Ritsumeikan University School of business administration.

-

Tatsuo Kogure

Director

Tatsuo Kogure has 12 years' experience in private equity investments. He focuses on semiconductors / electronics, material / chemical, mobility, consumer goods, and social infrastructure industries. Prior to joining JIC Capital, he worked at INCJ with 5 deals of business consolidations, curve-outs, co-intestments of overseas management resources, and growth capitals. Prior to INCJ, he worked at Nikko Citigroup (current Citigroup Global Markets Japan) and SMBC Nikko Securities as an investment banker. He holds B.S. from Waseda University School of commerce.

-

Seiji Ishioka

Director

Seiji Ishioka has 10 years' experience in private equity investments. He focuses on metals, basic materials, mobility, manufacturing / engineering, material / chemical, and social infrastructure industries. Prior to joining JIC Capital, he worked at INCJ with several deals of business consolidations, curve-outs, and growth capitals. He involved in the whole process from investments, value-ups to exits in 3 deals. Prior to INCJ, he worked at SMBC Nikko Securities as an investment banker from 2009 to 2015. He holds B.S. from Waseda University School of Science and Engineering and M.S. from Waseda University Graduate School of Business and Finance.

-

Hiroshi Matsuyuki

Director

Hiroshi Matsuyuki focuses on mobility, semiconductors / electronics, material / chemical, energy, and social infrastructure industries. Prior to joining JIC capital, he worked at UBS and Nomura Securities as an investment banker. He holds a B.S. from Waseda University School of Social Science and an MBA from MIT Sloan School of Management.

-

YO INOMATA

Director

Yo Inomata has 10 years' experience in private equity investments. He focuses on electronics, semiconductors and TMT related industries. Prior to joining JIC Capital, he worked at INCJ on 3 deals involving business consolidation, carve-out, and overseas investment. Prior to INCJ, he worked at Mizuho Financial Group as an investment banker. He holds a Bachelor of Laws from Keio University and an MBA from University of Michigan Ross School of Business.

-

SHIGETOMO OGAWA

Director

Shigetomo Ogawa has 9 years' experience in the private equity investments. He focuses on material / chemical, manufacturing / engineering, semiconductors / electronics, and transportation industries. Prior to joining JIC Capital, he worked at INCJ, where he was involved in four domestic transactions including industry restructuring, carve-outs, and venture investments. Prior to that, he worked in accounting and internal control auditing at Deloitte Tohmatsu, and in M&A advisory at Deloitte Tohmatsu Financial Advisory. He holds a Bachelor of Commerce degree from Waseda University. He is a Certified Public Accountant.

-

HIDENORI KAMBE

Director

Hidenori Kambe has over 20 years of experience in private equity investment. Before joining JIC Capital, he worked as a director of the investment team at one of Japan’s leading PE firms. He was involved in investment, value creation, and exits, primarily through carve-out deals. He began his career in venture capital and later joined the funding team of a buyout fund business, gaining extensive experience as a manager of the investment team.

He holds a Bachelor of Engineering from Waseda University and a Master of Science and Engineering from the Graduate School of Waseda University. -

YUSUKE ICHIHARA

Director

Yusuke Ichihara has 7 years’ experience in the Private equity investments. He focuses on mobility, healthcare, IT, manufacturing / engineering, and social infrastructure industries. Prior to joining JIC Capital, he worked at INCJ with 6 deals of buyouts, including domestic and international buyouts, business consolidations, carve-outs, growth capital, and startup investments. Prior to that, he worked in the investment banking division at Morgan Stanley, providing financial advisory service. He holds a bachelor's degree in economics from Keio University.

-

池内 省五Shogo

IkeuchiPresident and CEO

-

板橋 理Osamu

ItabashiManaging Director

-

貫名 保宇Yasutaka

NukinaManaging Director

-

伊藤 文一Fumikazu

ItoManaging Director

-

大西 圭介Keisuke

OhnishiManaging Director

-

野上 浩平Kohei

NokamiDirector

-

木暮 龍雄Tatsuo

KogureDirector

-

石岡 誠二Seiji

IshiokaDirector

-

松行 大志Hiroshi

MatsuyukiDirector

-

猪又 遥YO

INOMATADirector

-

小川 茂丈SHIGETOMO

OGAWADirector

-

神戸 秀典HIDENORI

KAMBEDirector

-

一原 祐介YUSUKE

ICHIHARADirector

access

Tokyo Toranomon Global Square

1-3-1 Toranomon, Minato-ku Tokyo

105-0001, Japan

CONTACT

For inquiry, please fill in the form below. Please be aware that we respond to inquiries approximately within a month only in case we are available to further asess them based on the provided information.